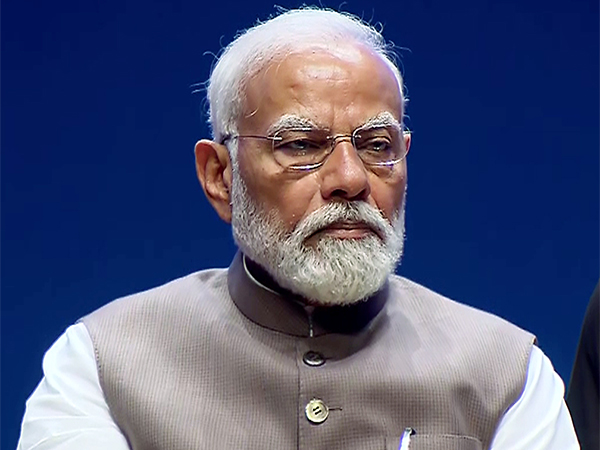

Mumbai (Mahaeashtra) [India], April 1 (ANI): Prime Minister Narendra Modi addressed the opening ceremony of RBI@90 in Mumbai, today, in the commemoration of the Reserve Bank of India’s (RBI) 90 years of service.

According to a release from the PM’s office, Prime Minister Modi unveiled a commemorative coin and applauded the pivotal role of the RBI in shaping India’s economic landscape.

Deeming the present RBI staff as fortunate, the Prime Minister said, “The policies drafted today will shape the next decade of RBI.”

Highlighting the significance of the next decade in India’s journey towards a developed nation, Prime Minister Modi stressed the RBI’s commitment to fast-paced growth, trust, and stability.

PM noted, “the next 10 years will take RBI to its centenary year”.

“The next decade is extremely important for the resolutions of a Viksit Bharat”, PM Modi said, highlighting the RBI’s priority towards fast-paced growth and focus on trust and stability. The Prime Minister also conveyed his best wishes for the fulfilment of its goals and resolutions.

He emphasized the need for clarity of policy, intentions, and decisions, asserting that the government’s strategy of recognition, resolution, and recapitalization has yielded transformative results.

“Where intentions are right, results too are correct”, said the Prime Minister.

Speaking on the comprehensive nature of reforms, the Prime Minister stated, “The government worked on the strategy of recognition, resolution and recapitalization. A capital infusion of 3.5 lakh crore was undertaken for the helping public sector banks along with many governance-related reforms.”

Drawing attention to the comprehensive reforms undertaken by the government, Prime Minister Modi noted the significant capital infusion into public sector banks and governance-related reforms, including the successful implementation of the Insolvency and Bankruptcy Code.

He highlighted the substantial reduction in gross NPAs of banks, indicating a marked improvement in the banking sector’s health.

PM Modi said, “More than 27,000 applications involving underlying defaults of more than Rs 9 lakh crore were resolved even before admission under IBC. Gross NPAs of banks that stood at 11.25 percent in 2018 came down to below 3 percent by September 2023.”

He said, “The problem of twin balance sheets is a problem of the past.”

Prime Minister Modi underscored the profound impact of the RBI’s initiatives on the lives of ordinary citizens, particularly in terms of financial inclusion.

He cited examples such as the Jan Dhan Yojana and PM Kisan Credit Cards, which have empowered millions of Indians in rural areas, thereby catalyzing economic growth.

PM said, “55 percent of the 52 crore Jan Dhan accounts in the country belong to women. The impact of financial inclusion in the agriculture and fisheries sector where more than 7 crore farmers, fishermen and cattle owners have access to PM Kisan Credit Cards providing a significant push to the rural economy.”

Referring to the boost for the cooperative sector in the past 10 years, the Prime Minister shed light on the importance of regulations of the Reserve Bank of India regarding cooperative banks.

He mentioned, “More than 1200 crore monthly transactions via UPI making it a globally recognized platform.”

The Prime Minister also touched upon the work being done on Central Bank Digital Currency and said, “The transformations of the past 10 years have enabled the creation of a new banking system, economy and currency experience.”

Emphasizing the importance of India’s economic self-reliance, Prime Minister Modi noted India’s increasing contribution to global GDP growth, positioning the nation as an engine of global growth.

“Today, India is becoming the engine of global growth with 15 percent share in global GDP growth”, PM Modi said.

He called for efforts to enhance the accessibility and acceptability of the Indian Rupee on the global stage, while also cautioning against the rising trends of excessive economic expansion and increasing debt levels.

“Debt levels of many countries are also creating a negative impact on the world”, PM Modi said.

The Prime Minister suggested RBI conduct a study on this keeping in mind the prospects and potential of India’s growth.

Prime Minister Modi highlighted the critical role of a strong banking industry in funding the nation’s developmental projects and emphasized the need for adaptation to technological innovations such as AI and blockchain.

He stressed the importance of cybersecurity in the digital banking ecosystem and advocated for a holistic approach towards the banking vision of a developed India.

PM Modi said, “Meeting the credit needs of global champions to street vendors, of the cutting edge sectors to traditional ones is critical for Viksit Bharat and RBI is the appropriate body for the holistic appreciation of the banking vision of Viksit Bharat.”

The event saw the presence of dignitaries including the Governor of Maharashtra, Ramesh Bains, Chief Minister of Maharashtra, Eknath Shinde, Union Finance Minister Nirmala Sitharaman, and RBI Governor Shaktikanta Das, among others. (ANI)

Disclaimer: This story is auto-generated from a syndicated feed of ANI; only the image & headline may have been reworked by News Services Division of World News Network Inc Ltd and Palghar News and Pune News and World News

HINDI, MARATHI, GUJARATI, TAMIL, TELUGU, BENGALI, KANNADA, ORIYA, PUNJABI, URDU, MALAYALAM

For more details and packages